QSBS Eligibility Tracker and Calculator

A free Google Sheet to help investors identify and track qualified small business stock (QSBS) eligibility and calculate potential tax savings across a portfolio of venture investments.

A free Google Sheet to help investors identify and track qualified small business stock (QSBS) eligibility and calculate potential tax savings across a portfolio of venture investments.

Startup investors in the United States have the potential to benefit from qualified small business stock (QSBS) tax treatment for capital gains from startup founders and early investors, potentially reducing the tax liability down to zero on the first $10mm in returns.

Stripe explains QSBS in detail here:

Holding qualified small business stock (QSBS) can radically change the capital gains tax liability for startup founders and early investors. They can receive as much as a 100% exemption on federal capital gains taxes up to $10 million, or 10 times the original investment. Savvy entrepreneurs are increasingly using QSBSs to maximize financial returns.

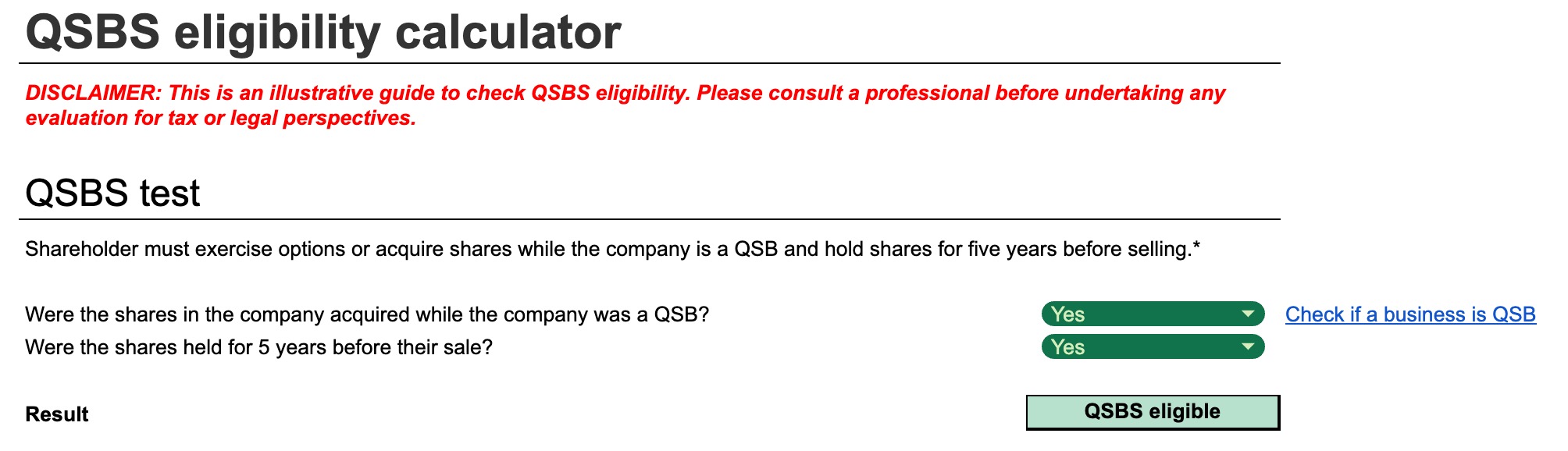

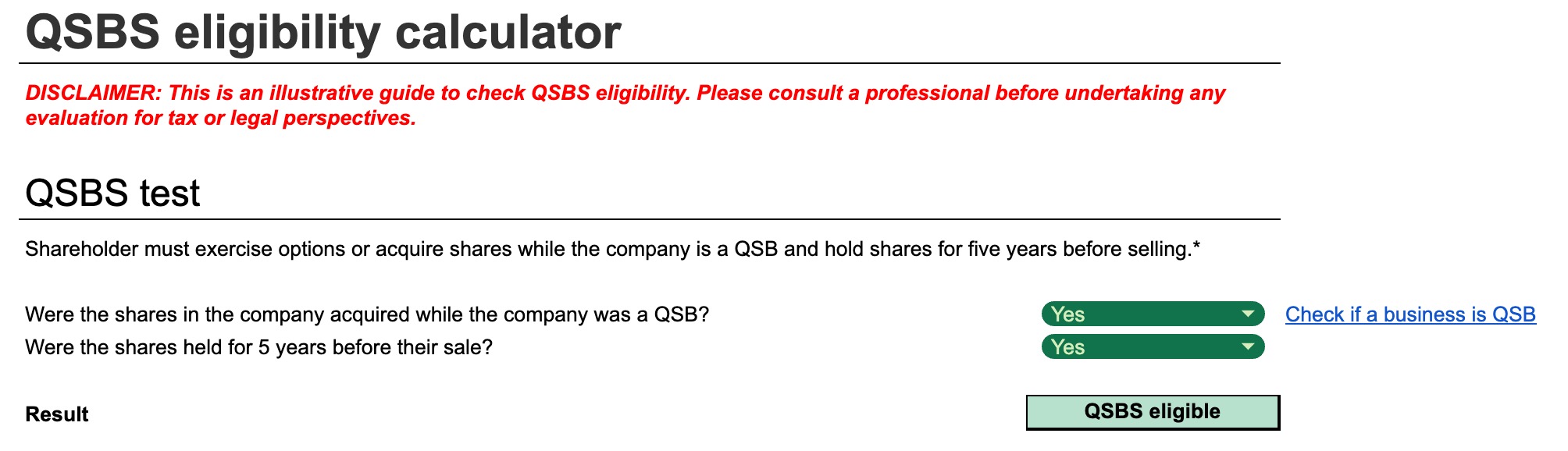

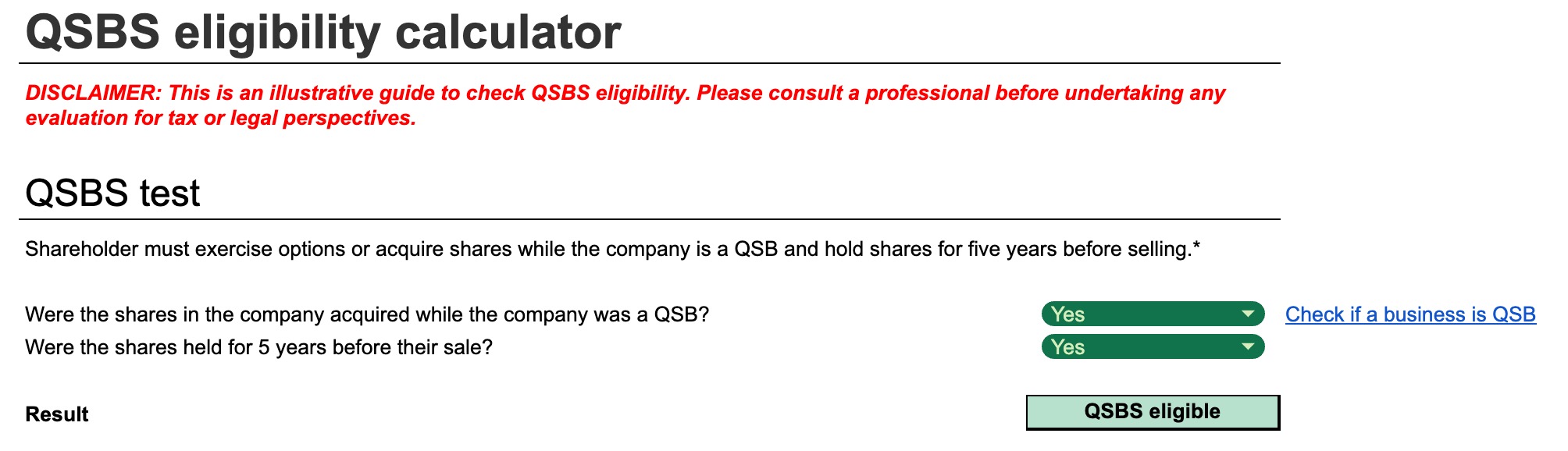

Tracking the eligibility of investments can take a lot of work to understand whether investments are eligible and how large the tax benefits can be. The QSBS Eligibility VC Tracker by Graph Advisors is a free Google Sheet model that:

This tool is not tax advice. If you have questions regarding taxes and your portfolio, please contact your tax professional.

This tool is provided by Graph Advisors, a firm that provides services and tools to help venture capital funds and allocators develop operational excellence. Questions, support, and more, contact Graph Advisors.

Graph Advisors

We save investors and allocators time, headache, and money so they can focus on what they do best.

We're here to serve GPs and funds building enduring firms. Our services and tools are built to empower you and your team.

Our team has led and delivered large-scale capital allocation accelerators, software, design and projects in multiple startups and high-growth environments like On Deck, Expa, Union Square Ventures, J.P. Morgan, and Antler.

More details at Graph Advisors